Life Insurance

Life insurance is about protecting the people you love and securing their future, no matter what life brings. It provides financial support to ease the burden left behind. Helping families break generational cycles and avoid relying on GoFundMe or selling food plates during difficult times. With several types of coverage available, 9ja Insurance takes the time to understand your goals and budget, then compares options to find a plan that truly fits your needs. Our goal is simple: to help you secure the right coverage with clarity, care, confidence, and cost-effective solutions.

Life Insurance:

A contract with an insurer to pay a sum (death benefit) to beneficiaries upon the insured’s death, in exchange for premiums.

Policyholder (Owner):

The person who owns the policy, pays premiums, and controls it.

Insured:

The person whose life is covered by the policy (can be different from the policyholder).

Beneficiary:

The person or entity designated to receive the death benefit.

Premium:

The regular payment (monthly, annually, etc.) to keep the policy active.

Face Value /Death Benefit:

The amount paid out to beneficiaries, also called the sum assured or payout.

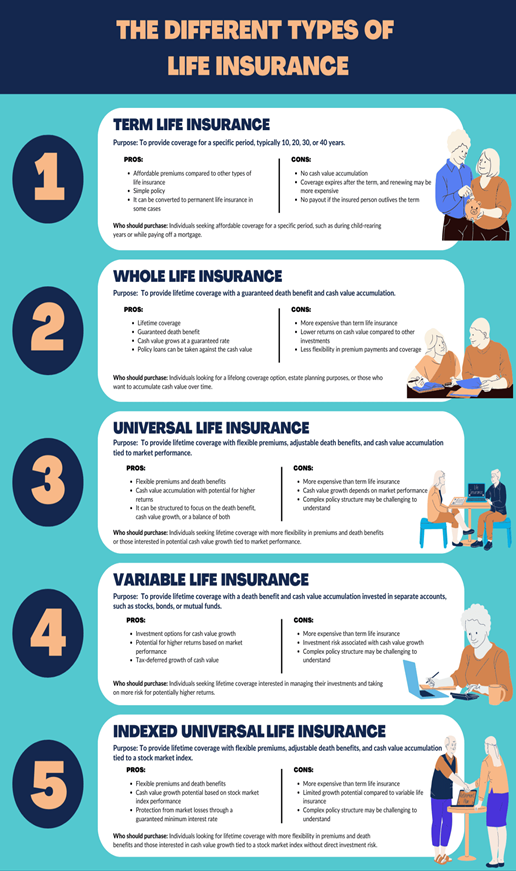

Term Life:

Provides coverage for a specific period (e.g., 10, 20 years) and pays only if death occurs during that term; no cash value.

Whole Life:

Permanent insurance covering your entire life, building cash value over time that can be borrowed against or surrendered.

Cash Value:

A savings component in permanent policies that grows tax-deferred.